DeFi Option Pricing Demystified Builds Volatility Models and IV Surfaces

Decentralized finance has democratized option trading, but with that power comes a responsibility to price derivatives fairly and transparently. By understanding how to collect on‑chain price data, model realized volatility, compute implied volatility, and construct IV surfaces, DeFi participants can:

- Provide liquid, correctly priced options

- Hedge effectively against token volatility

- Detect and exploit arbitrage opportunities

- Build trust in the ecosystem through transparent, on‑chain data

Volatility is not a mystical concept reserved for Wall Street analysts. It is a measurable, modelable property that, when applied properly, empowers anyone with a smart‑contract wallet to play the options game on a truly open market. The next time you see a DeFi option, pause for a moment and think: What is the volatility behind this premium? Knowing the answer can mean the difference between profit and loss in a world where the only fee is your own lack of knowledge.

Introduction

Decentralized finance (DeFi) has democratized option trading, but with that power comes a responsibility to price derivatives fairly and transparently. By understanding how to collect on‑chain price data, model realized volatility, compute implied volatility, and construct IV surfaces in DeFi, participants can:

- Provide liquid, correctly priced options

- Hedge effectively against token volatility

- Detect and exploit arbitrage opportunities

- Build trust in the ecosystem through transparent, on‑chain data

Volatility is not a mystical concept reserved for Wall Street analysts; it is a measurable, modelable property that, when applied properly, empowers anyone with a smart‑contract wallet to play the options game on a truly open market.

Black‑Scholes and Realized Volatility

1. Gathering Spot Data

Pull the underlying asset’s price from an oracle. A typical implementation in Solidity might look like this:

function getPrice(address asset) external view returns (uint256) {

// Implementation depends on oracle provider

}

The getPrice() function is a standard pattern in many DeFi option contracts.

2. Calculating Realized Volatility

Realized volatility tells you what has happened. A simple approach is to compute the daily log‑returns of the underlying asset over a rolling window and then annualize:

import numpy as np

import pandas as pd

# Example: daily log returns of an asset

returns = np.log(price[t] / price[t-1])

realized_volatility = np.sqrt(np.mean(returns**2)) * np.sqrt(365)

For a more robust measure, you can use the Realized Volatility methodology described in our post on

DeFi Finance Fundamentals: Option Pricing, Volatility, and IV Surface Construction.

Implied Volatility

1. What Is Implied Volatility?

Implied volatility is derived by inverting the option pricing formula. In many DeFi projects, we use a variant of the Black‑Scholes formula:

Because the Black‑Scholes formula is not analytically solvable for σ, we numerically solve for it using the bisection method or Brent’s algorithm.

You can find a full implementation and step‑by‑step walk‑through in our guide on Step‑by‑Step DeFi Option Valuation: Modeling Volatility and Calculating Implied Volatility.

2. Using Implied Volatility

Implied volatility is a forward‑looking metric that captures the market’s expectations of future volatility. By feeding it into your option pricing model, you can price options that are consistent with the current market sentiment.

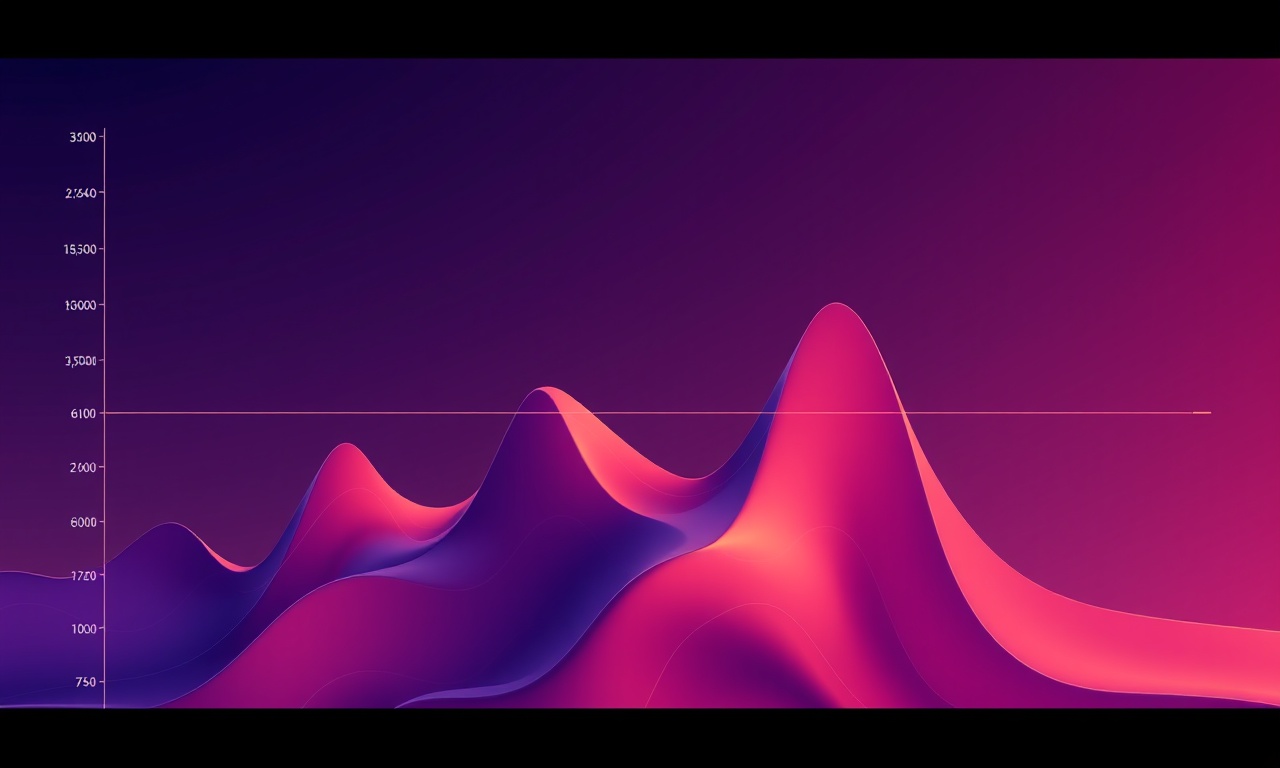

IV Surface

1. Visualizing Volatility

An IV surface reveals the smile or skew patterns that indicate how volatility changes across strikes and maturities. For a deeper dive into IV surfaces and how to interpret them, see our post on

DeFi Finance Fundamentals: Option Pricing, Volatility, and IV Surface Construction.

2. Storing IV Data on‑Chain

Option protocols can store a truncated version of the IV surface on‑chain, which allows on‑chain analytics and risk‑management tools to work without relying on external services. This approach is detailed in

DeFi Finance Fundamentals: Option Pricing, Volatility, and IV Surface Construction and is a cornerstone of many DeFi protocol designs.

Conclusion

Volatility is not a mystical concept reserved for Wall Street analysts. It is a measurable, modelable property that, when applied properly, empowers anyone with a smart‑contract wallet to play the options game on a truly open market. By mastering the art of collecting on‑chain price data, modeling realized volatility, computing implied volatility, and building IV surfaces, you can make informed decisions that go beyond guesswork.

The next time you see a DeFi option, pause for a moment and think: What is the volatility behind this premium? Knowing the answer can mean the difference between profit and loss.

What is the implied volatility behind this premium?

Knowing the answer can mean the difference between profit and loss in a world where the only fee is your own lack of knowledge.

Read more about building volatility models in DeFi in our guide on DeFi Finance Fundamentals Option Pricing Volatility and IV Surface Construction.

.png)

Lucas Tanaka

Lucas is a data-driven DeFi analyst focused on algorithmic trading and smart contract automation. His background in quantitative finance helps him bridge complex crypto mechanics with practical insights for builders, investors, and enthusiasts alike.

Random Posts

Smart Contract Risk DeFi Insurance and Capital Allocation Best Practices

Know that smart contracts aren’t foolproof-beyond bugs, the safest strategy is diversified capital allocation and sound DeFi insurance. Don’t let a single exploit derail your portfolio.

8 months ago

Dive Deep into DeFi Protocols and Account Abstraction

Explore how account abstraction simplifies DeFi, making smart contract accounts flexible and secure, and uncover the layered protocols that empower open finance.

8 months ago

Token Standards Unveiled: ERC-721 vs ERC-1155 Explained

Discover how ERC-721 and ERC-1155 shape digital assets: ERC-721 gives each token its own identity, while ERC-1155 bundles multiple types for efficiency. Learn why choosing the right standard matters for creators, wallets, and marketplaces.

8 months ago

From Theory to Practice: DeFi Option Pricing and Volatility Smile Analysis

Discover how to tame the hype in DeFi options. Read about spotting emotional triggers, using volatility smiles and practical steps to protect your trades from frenzy.

7 months ago

Demystifying DeFi: A Beginner’s Guide to Blockchain Basics and Delegatecall

Learn how DeFi blends blockchain, smart contracts, and delegatecall for secure, composable finance. This guide breaks down the basics, shows how delegatecall works, and maps the pieces for users and developers.

2 months ago

Latest Posts

Foundations Of DeFi Core Primitives And Governance Models

Smart contracts are DeFi’s nervous system: deterministic, immutable, transparent. Governance models let protocols evolve autonomously without central authority.

2 days ago

Deep Dive Into L2 Scaling For DeFi And The Cost Of ZK Rollup Proof Generation

Learn how Layer-2, especially ZK rollups, boosts DeFi with faster, cheaper transactions and uncovering the real cost of generating zk proofs.

2 days ago

Modeling Interest Rates in Decentralized Finance

Discover how DeFi protocols set dynamic interest rates using supply-demand curves, optimize yields, and shield against liquidations, essential insights for developers and liquidity providers.

2 days ago