Game Theory Meets DeFi Protocols Modeling Tokenomics For Optimal Incentives

Learn how game theory and financial math blend to design tokenomics that align incentives, manage risk, and build healthy DeFi ecosystems.

DEFI FINANCIAL MATHEMATICS AND MODELING

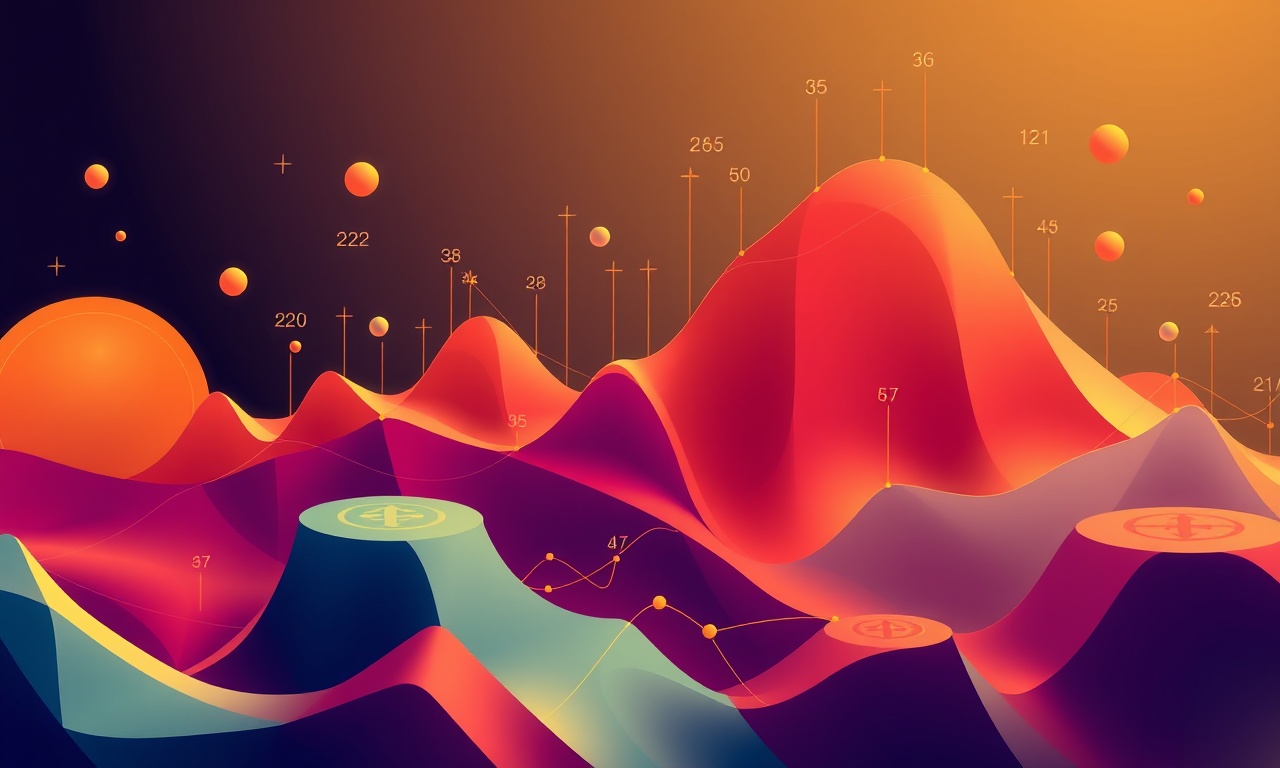

Build and evaluate token supply models, incentive structures, and economic simulations that ensure sustainable, growth, oriented protocols.

Learn how game theory and financial math blend to design tokenomics that align incentives, manage risk, and build healthy DeFi ecosystems.

Discover how mean-variance theory turns a DAO’s token list into a balanced treasury, using math to hedge against flash crashes and smart-contract risks.

1 week ago

Learn how game theory designs token incentives that self balance supply, curbing volatility while fostering growth and scarcity for sustainable DeFi ecosystems.

1 week ago

Simulate DeFi protocol economics with game theory to test and refine token incentives before launch, ensuring robust, balanced systems that adapt to market dynamics.

2 weeks ago

Discover how discounted cash flow can reveal the true value of DeFi protocols, turning code into tangible economic insight for investors, developers, and regulators.

2 weeks ago

Learn how math turns DeFi rules into reliable token rewards, balancing risk and incentives to build fair, sustainable protocols.

2 weeks ago

Use classic finance math to model DeFi returns, volatility, and correlations. Build a step, by, step investment plan, then diversify your DAO treasury to balance risk and reward.

2 weeks ago

Learn how DeFi protocols work like a garden, removing middlemen, and discover why they matter for everyday investors and why holding tokens is more than just a habit.

Discover how game theory and DeFi analytics blend to craft tokenomics that balance supply, demand, and incentives, building sustainable digital economies that attract users and resist market shocks.

Explore how advanced math transforms DeFi token data into dynamic trade models, revealing hidden incentives, liquidity flows, and governance impact for analysts, devs, and researchers.

Discover how to build a resilient DeFi treasury by balancing yield, smart contract risk, governance, and regulation. Learn practical tools, math, and a real world case study to safeguard growth.

Tokenomics turns a DeFi protocol into a thriving ecosystem, mapping token supply, distribution, and rules into incentives that let liquidity grow and participants prosper, like a garden where every drop of value nourishes all.